Statistics won’t support phasing out cheques in rural, regional Australia

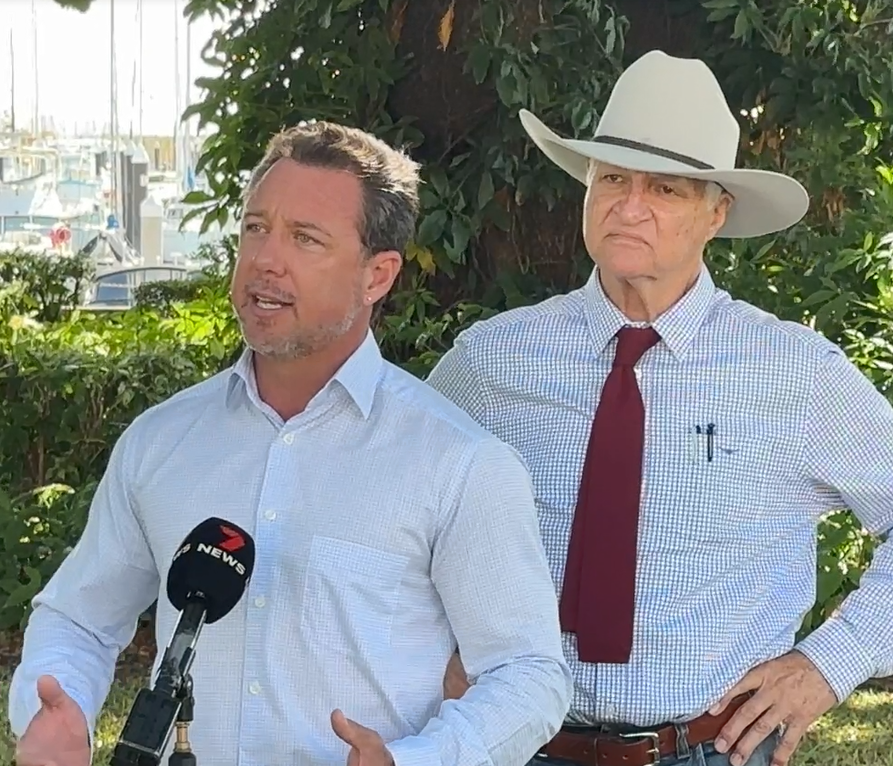

Hinchinbrook MP and KAP Deputy Leader, Nick Dametto and Federal Kennedy MP, Bob Katter.

8 June 2023

Phasing out cheques will be detrimental to rural and regional transactions and their respective local economies, Katter’s Australian Party (KAP) is warning.

It comes as the Federal Treasurer on Wednesday announced a complete phasing out of cheques by 2030.[1]

Federal Kennedy MP Bob Katter and KAP Deputy Leader and Hinchinbrook MP Nick Dametto have continuously reminded corporate leaders and governments of the importance of bricks and mortar banking, as well as cash, to the rural and regional communities they represent.

The North Queensland MPs have argued statistics which are often presented along with these decisions, don’t accurately portray the needs of the demographics of their communities and are typically skewed to the metropolis.

“They’ll tell you only 10 per cent are using cash here, or that cheque transactions are down by a certain percentage. Well in the rural and regional area I represent, this decision definitely raises concerns about the impact on farmers, small businesses and pensioners – where cheque usage is higher,” Mr Katter said.

“What right do you have to stop us from making a contract with another person? You take away cash and cheques from those that rely on this means, you take away the economy of a regional town.

“We have the right to control our money – physical cash and cheques give us that control. Banks do not, our balances are controlled by the banks.”

Mr Katter said he feared “phasing out cheques” was a stepping stone toward phasing out cash all together.

“I will do everything humanly possible to resist tenaciously the abolition of cheques.

“We will be lobbying the crossbench and the opposition and I hope and pray that we can get unanimity to tenaciously oppose this.”

Mr Dametto labelled cheque books as the “tool of choice” for country people conducting business.

“It hasn’t always been convenient to carry large wads of cash,” Mr Dametto said.

“The Government and banks have successfully killed off large cash transactions by making it illegal to purchase anything over $10,000 with physical money.

“Now, city bankers who don’t understand the regions are trying to kill off the cheque in the name of convenience and security. What they don’t understand is, many places in regional Queensland lack the internet connectivity to utilise on the spot digital banking.

“To me this just seems like another step towards a fully digital currency and part of the process of removing bricks and mortar and face-to-face banking.”

-END-

[1]Death of the cheque by 2030 as Australia embraces digital payment reforms | Banking | The Guardian